The Theodore Edson Parker Foundation was established in 1944 in Lowell, Massachusetts, under a will that reflected the founder’s interest in a wide range of community needs including children, disadvantaged young women, the elderly, refugees and immigrants. Since then, trustees have expanded our priorities to many other needs of the residents of Lowell.

The Parker Foundation’s primary goal is to make effective grants that benefit the residents of the City of Lowell. Grants are made for a variety of purposes including social services, cultural programs, community development activities, education, community health needs, and urban environmental projects. The foundation funds specific needs including special programs and projects, capital improvements and equipment purchases, and technical assistance. The trustees do not usually award funds for the operating expenses of well-established organizations, for endowment, or to fund deficits. Grants are restricted to organizations that are tax-exempt under Section 501(c)(3) of the Internal Revenue Code and are classified as “not a private foundation” under Section 509(a). No awards are made to individuals.

The Form 990-PF may be found at www.guidestar.org.

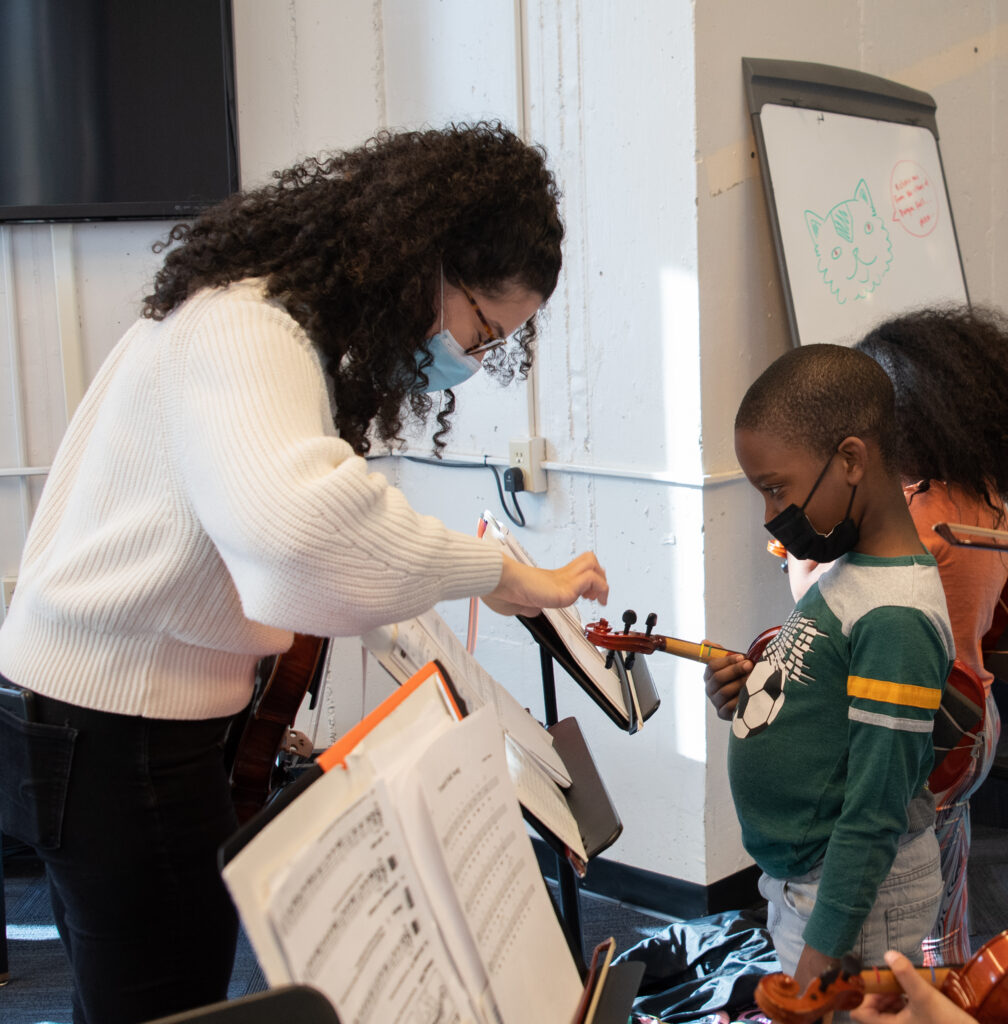

In his will, Mr. Parker suggested that his trustees give special consideration to the welfare of children, disadvantaged young women, and the elderly. The foundation is especially committed to assisting these and other under-served groups, including refugees and immigrants, to create a more caring and equitable community. The foundation favors applications from organizations with balanced representation in staff and management, reflecting constituents served and the diverse community that Lowell has become. For more information on the importance of equity and inclusion and how to successfully move in this direction, refer to articles from Independent Sector, Council of Foundations, Nonprofit HR, Building the Movement Project, and the Nonprofit Quarterly with the Young Nonprofit Professionals Network.

Applying for a Grant:

To apply for our regular grant

In recognition of the needs of smaller organizations, the Theodore Edson Parker Foundation offers mini-grants for requests up to $7,500.

Who is eligible?

Mini-grant applications will be reviewed on a quarterly basis.

Organizational and Project Budget

To apply for a mini-grant